capital gains tax canada changes

A comprehensive capital gains tax in the UK. Was introduced in 1965.

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

Proposed tax changes for Canada - 2022 Canadian federal government releases significant package of draft tax legislation Feb 7 2022 On February 4 2022 the federal.

. The below outlines the current tax treatment of capital gains in Canada and the US the appetite for change in each country and a few questions to ask your financial planner. On the flip side an. Federal Tax Rate Brackets in 2022.

Tax Changes in 2022. The capital gains tax is the same for everyone in Canada currently 50. The amount of tax youll pay depends on how.

But tax on capital gains is partially offset by declared Net capital losses of other years which I estimate reduced the net total tax expenditure to 157 billion per year. For instance if you buy a property. Currently under Canadian tax law only 50 of capital gains are taxable at your marginal rate.

Canada Tax Capital Gains Tax Income Tax. When you sell a capital property for more than you paid for it this is called a capital gain. Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972.

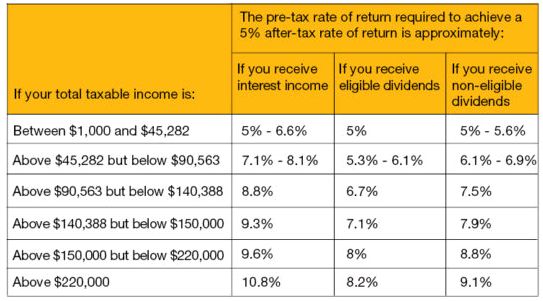

You must pay taxes on 50 of this gain at your marginal tax rate. In our example you would have to include 1325 2650 x 50 in your income. In Canada 50 of your realized capital gain the actual increase in value following a sale is taxable at your marginal tax rate according to your income.

Only half of the capital gain from any sale will be taxed based on the marginal tax rate which differs between each province. Australia introduced a similar tax later in 1985. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large.

There has been speculation from advisors and investors that capital gains taxes may be. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. New tax changes are set to come into force on January 1 2017 with respect to the income tax treatment of Goodwill.

When the tax was first. In Canada 50 of the value of any capital gains is taxable. The government would like to see the tax rate on both capital gains and dividend income be the same.

Currently depending on your tax bracket a capital gain is taxed at a rate. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for. For the 2021 tax year and tax season the deadline to file tax returns for most filers is May 2 2022.

To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an. The inclusion rate refers to how much of your capital gains will be taxed by the CRA. This means that only half of your capital.

Is more mixed where capital. In the 2022 budget announcement the federal. So for example if you buy a stock at 100 and it earns 50 in value when you sell it the total capital.

For now the inclusion rate is 50. The experience in the US.

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Short Term And Long Term Capital Gains Tax Rates By Income

Savings And Investment Oecd Capital Gains Tax Retirement Accounts

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada

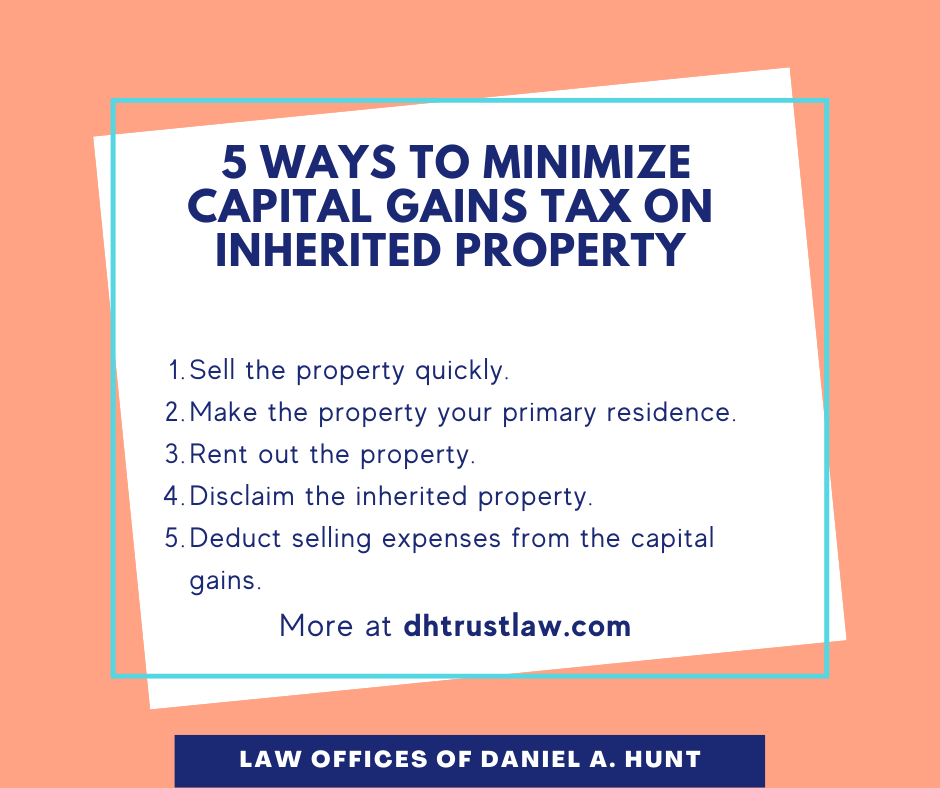

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Capital Gains Tax In Canada Explained

What Is Tax Gain Harvesting Charles Schwab

Capital Gains Tax What Is It When Do You Pay It

Double Taxation Of Corporate Income In The United States And The Oecd

Historical Capital Gains Rates Wolters Kluwer

Canada Crypto Tax The Ultimate 2022 Guide Koinly

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Tax Burden On Capital Income International Comparison Tax Foundation

Smythe Llp Possible Changes Coming To Tax On Capital Gains In Canada